🪢Musubi - Chain Abstraction

TLDR

Musubi is the chain Abstraction Layer of Kinto.

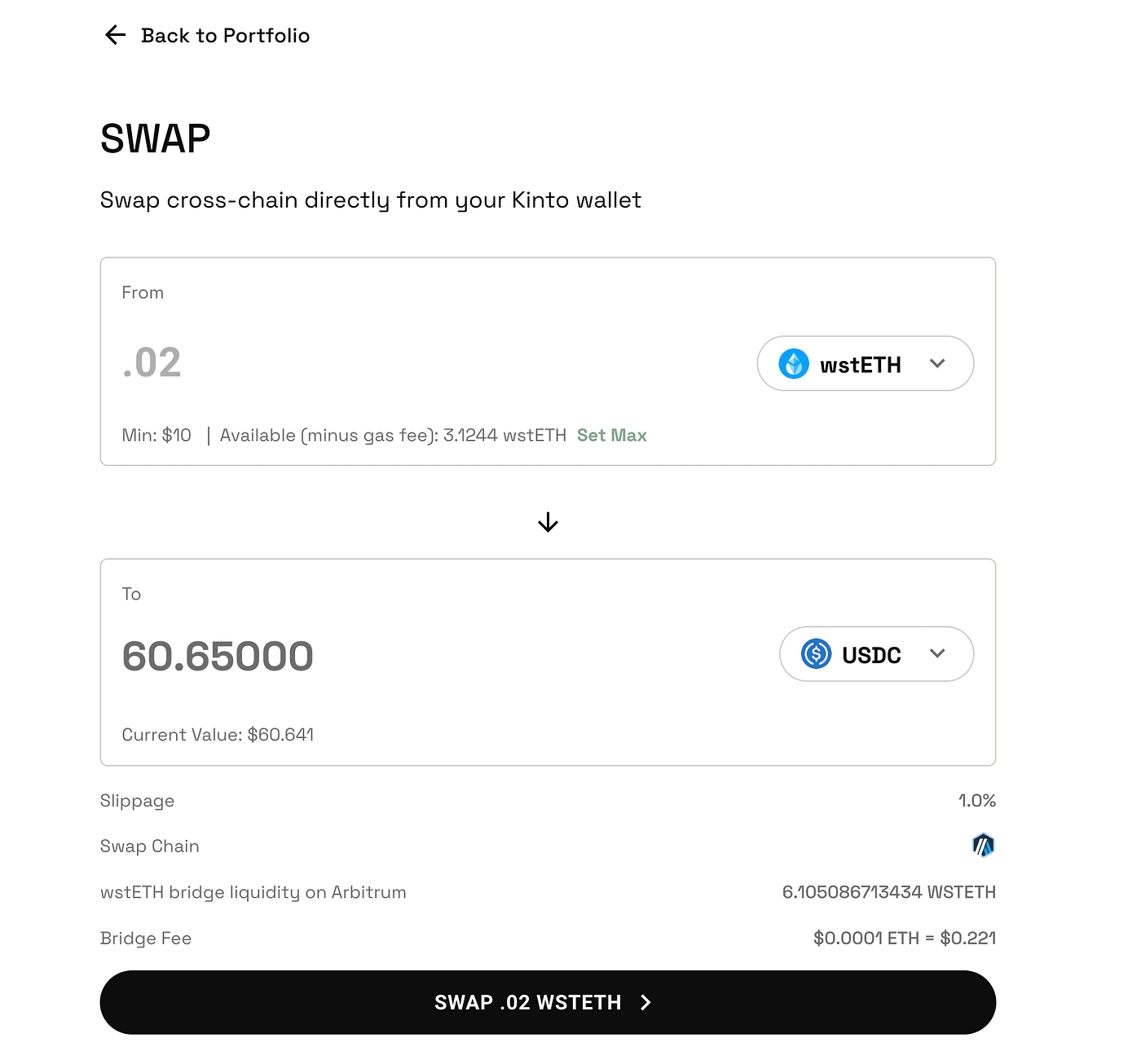

Kinto is the first to offer non-custodial chain abstracted swaps.

Musubi unties the fragmented liquidity and unites Ethereum.

Simplifies swaps, saving time and minimizing slippage and gas costs for users.

Users can swap across Mainnet, Arbitrum, and Base directly from their Kinto wallet.

Users are always in complete control of the funds. Just Two signatures are required.

Since we started our Kinto journey, we have made it clear that we will not fragment liquidity. We do not believe in a future where hundreds of L2s repeatedly bootstrap the same token pools. i.e. USDC-ETH.

If you are building an L2 and replicating the same pools already available on Mainnet or Arbitrum with worse liquidity, you are subtracting value from the ecosystem. Worse, you are subtracting value from consumers and liquidity deployers to pump your bags.

Lately, criticizing Ethereum and its rollup-centric scaling model has become popular. The top concerns are the fragmentation of liquidity and the UX nightmare created by bridges. Those problems are now melting away…

We announce Musubi, the chain abstraction layer of Kinto.

☯️ Ethereum Duality

Solana's main complaint is valid. Users can’t interact with hundreds of chains, wallets, and protocols—hell no, users do not care how it is done.

Users do not need to know which data centers route their Zoom calls or which protocols or chains their assets are being exchanged in. For users and liquidity providers, Ethereum should feel like a unified source of liquidity.

Conversely, the rollup-centric model has spurred innovation, allowing teams to innovate across every stack layer, from Data Availability and Settlement to execution. Kinto could only exist within the rollup-centric model. To maximize experimentation, Ethereum should be customizable.

Musubi integrates this duality and offers the best of both worlds:

A customized EVM with enforced account abstraction and user-owned KYC/AML to provide maximum security with delightful UX.

A non-custodial orchestration layer to pierce through the fragmented ecosystem and perform non-custodial swaps across any chain.

Musubi aligns incentives across the Ethereum ecosystem, promoting integration rather than liquidity fragmentation. We’re doing our part to create a more cohesive and user-friendly ecosystem.

Untie the fragmented liquidity, and you will unite Ethereum.

🪢 What is Musubi?

Musubi (結び) is a knotting technique with a deeper meaning in Japanese culture. It is referred to as the power of creation, the interconnecting energy of the universe. This concept directly influenced the Kinto logo and has been a pillar for us.

In the context of liquidity, Musubi unleashes trapped liquidity across isolated rollups, creating a fluid and interconnected DeFi ecosystem—a tapestry of braids that can be interwoven to create a more profound and substantial whole.

Benefits of Musubi

Reduced Slippage: By aggregating liquidity across chains, Musubi dramatically reduces slippage and maximizes trade efficiency.

Lower Costs: This approach minimizes the need for multiple bridging steps, significantly reducing time and gas costs.

Seamless Experience: We’re creating the illusion that Ethereum is once again a unified chain. You can access the best liquidity wherever it is without knowing the underlying mechanics.

For example, a user swapping ETH for USDC from a typical L2 might save several minutes, up to 2% on slippage, and $50 on gas fees compared to traditional cross-chain swaps.

By aggregating liquidity across chains, Musubi dramatically reduces slippage and maximizes trade efficiency. This approach minimizes the need for multiple bridging steps, significantly reducing time and gas costs.

We’re creating the illusion that Ethereum is once again a unified chain. You can get the best liquidity without knowing where it is, how to get there, or what’s happening under the hood.

Kinto users can now swap any asset wherever it is most liquid (Arbitrum, Base, Mainnet) and receive the assets back in their Kinto wallet. Users need not worry about gas, paying bridge fees in different chains, or dealing with changing token addresses and bridges.

Thanks to our account abstraction and chain abstraction implementations, this can be done in less than 60 seconds and, for the first time, in a fully non-custodial manner.

Try it here https://engen.kinto.xyz/swap.

If you are new to Kinto, you must create an account first.

⚙️ How does it work?

It is crucial to understand that Kinto is much more than a layer two on Ethereum. It is a Layer 2 with a custom wallet and a built-in identity layer. The built-in identity layer protects users by eliminating bots and minimizing fraudulent transactions.

Our custom wallet pairs enterprise-grade security features with wallet insurance and delightfully simple UI/UX powered by passkeys and account abstraction. You can learn more about our wallet here.

We want to give props to our friends at Socket. Our collaboration has heavily influenced Musubi. We share a common goal of unifying liquidity and reducing fragmentation across the Ethereum ecosystem, and that’s why they are our chain abstraction partner.

Our fully customized stack allows Kinto to be the first to implement chain abstracted swaps across all blockchain wallets via Musubi and Socket.

The way it works is the following:

The user selects the swap details and receives a quote that includes a chain for the swap.

The user then is prompted for a signature to withdraw the asset from their Kinto wallet to the chain where the swap will be performed.

The assets are withdrawn to a user-specific contract deployed on that chain and owned by the Turnkey signer of its Kinto wallet.

Once the assets are withdrawn, the user is prompted for a new signature to perform the swap and bridge the assets back to their Kinto Wallet.

Right now, it takes two signatures and two transactions, but soon, we can reduce this process to just a single signature by fronting liquidity from our paymaster.

Last updated