🛡️Wallet Insurance

TLDR

Kinto becomes the first L2 to offer native wallet insurance.

We have partnered with Breach to offer this policy to all Kinto users with over $250 in assets.

Users get $2,500 default coverage protection against smart contract hacks and cyber-attacks.

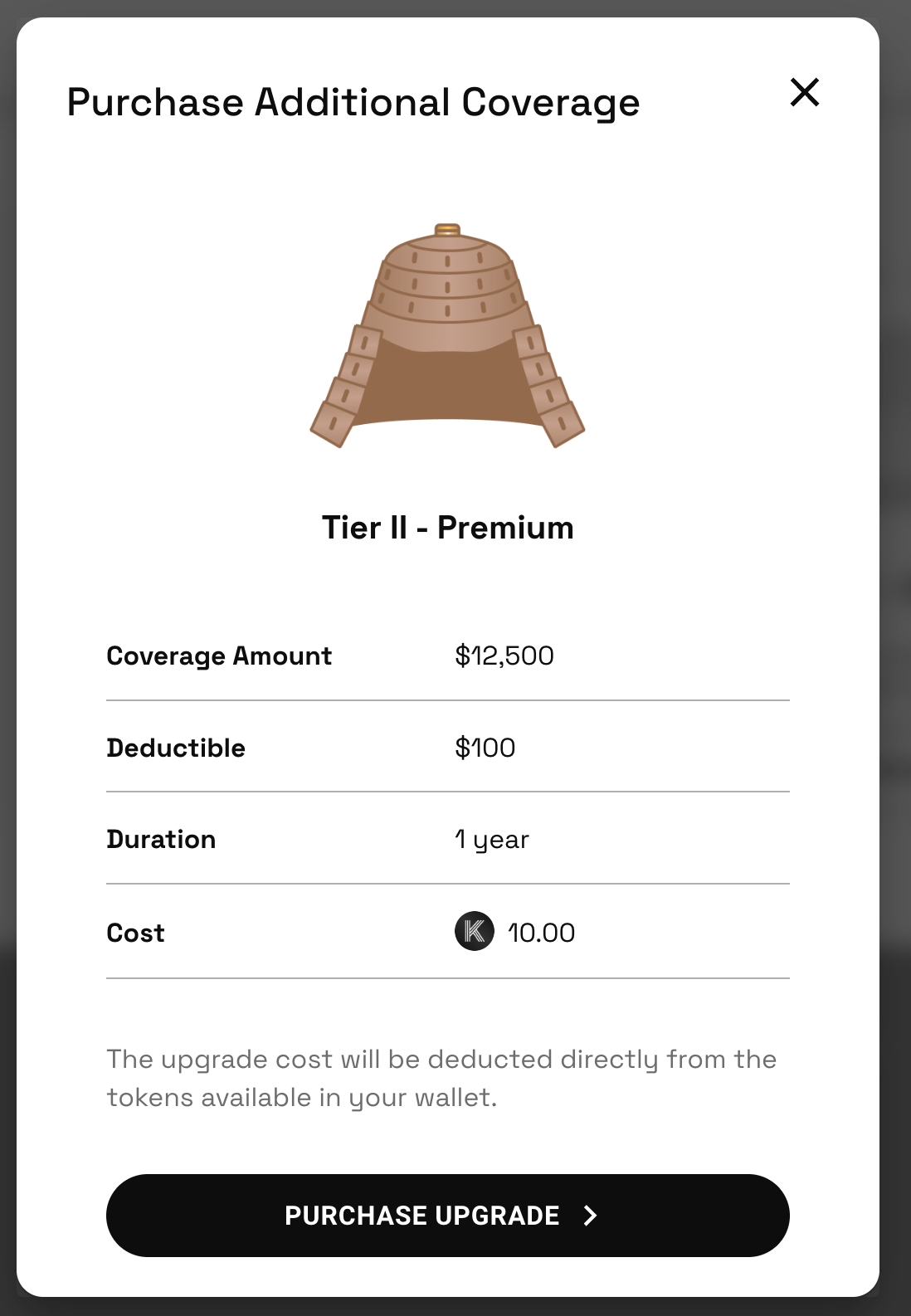

Kinto users can increase their coverage by purchasing additional coverage.

Kinto has been designed from the ground up to provide safe access to the on-chain financial system. We created an L2 from scratch to have native sybil resistance via user-owned KYC and mandatory smart contract wallets through account abstraction.

Today, we are excited to take our commitment to security one step further. Kinto is now the first blockchain network to offer wallet protection against smart contract hacks and cyber-attacks to our users.

🛡Security is not a choice

Kinto has the potential to improve our current financial system substantially. Thanks to the unique characteristics of blockchain networks, we can unlock benefits such as instant settlement, 24/7 access, increased efficiency, and reduced fees through disintermediation.

However, users and investors will not care about these benefits if they get hacked, rugged, or phished repeatedly. More than $30B was lost in 2022 alone.

Kinto was created as a haven for users to protect them from these traumatic events. Being inside Ethereum allows us to offer the best digital and RWA products from the ecosystem while having our L2, which enables us to customize it and deliver a 10x improvement in security.

We wrote a blog post detailing the security practices that make Kinto the safety-first L2. Thanks to these protective security layers, we can go one step further and offer insurance through our partnership with Breach.

🤝 Breach — Insurance for the Digital Era

Breach is a leading underwriter in the digital asset space. It is licensed and fully regulated and offers a suite of products for institutional and retail users. The team behind Breach has decades of experience in the underwriting industry, having worked at Allied World, Liberty Mutual, and Uber, among others.

We are delighted to partner with Breach Insurance, a Bermuda IIGB insurer, to offer Kinto wallet coverage against thefts and hacks. Breach Insurance provides and administers the Kinto wallet coverage.

This document explains the terms and conditions of this coverage to help you understand your benefits and responsibilities as a Kinto user.

🛡 Wallet Protection

As a Kinto user, you can now check your wallet protection directly on your account page. You are automatically covered under the policy if you have more than $250 in assets in your Kinto Wallet.

Head to https://engen.kinto.xyz/account to verify your coverage.

You can upgrade your wallet's coverage by clicking on the button above. Extended coverage lasts one year, and two additional premium tiers are available.

Kinto users can use K tokens to increase coverage, giving them an exclusive ability to maximize their security. Purchasing wallet coverage is the first $K token mechanic.

In case of a claim, Kinto ID holders will file a claim through [email protected]. This process will take place between the claimant and Breach Insurance directly.

Last updated